Sep 19 2022

Published by

NYU Shanghai

About 80 scholars, economists, and researchers from around the world gathered virtually from August 22 to 26 for the 2022 Society for Financial Econometrics (SoFiE) Summer School. This is the fifth year that the Volatility Institute at NYU Shanghai (VINS) has hosted the SoFiE Summer School. The week-long research-based course in statistics, econometrics, and finance is aimed at PhD students, researchers, and junior faculty. Previous hosts of the summer school include Oxford, Harvard, and the Kellogg School of Management, Northwestern University.

This year’s summer school course was themed on “Anomalies and Factor Models”, which has been one of the most important topics not only in academia but also in the financial industry. Factor models study the common factors that affect stocks' returns. The violations of factor models are called "Anomalies". Scholars have been searching for the best parsimonious factors that can explain the difference in stock returns. Asset managers also utilize the factor models to construct their portfolios and try to find the anomalies to beat the overall markets and therefore achieve abnormal returns.

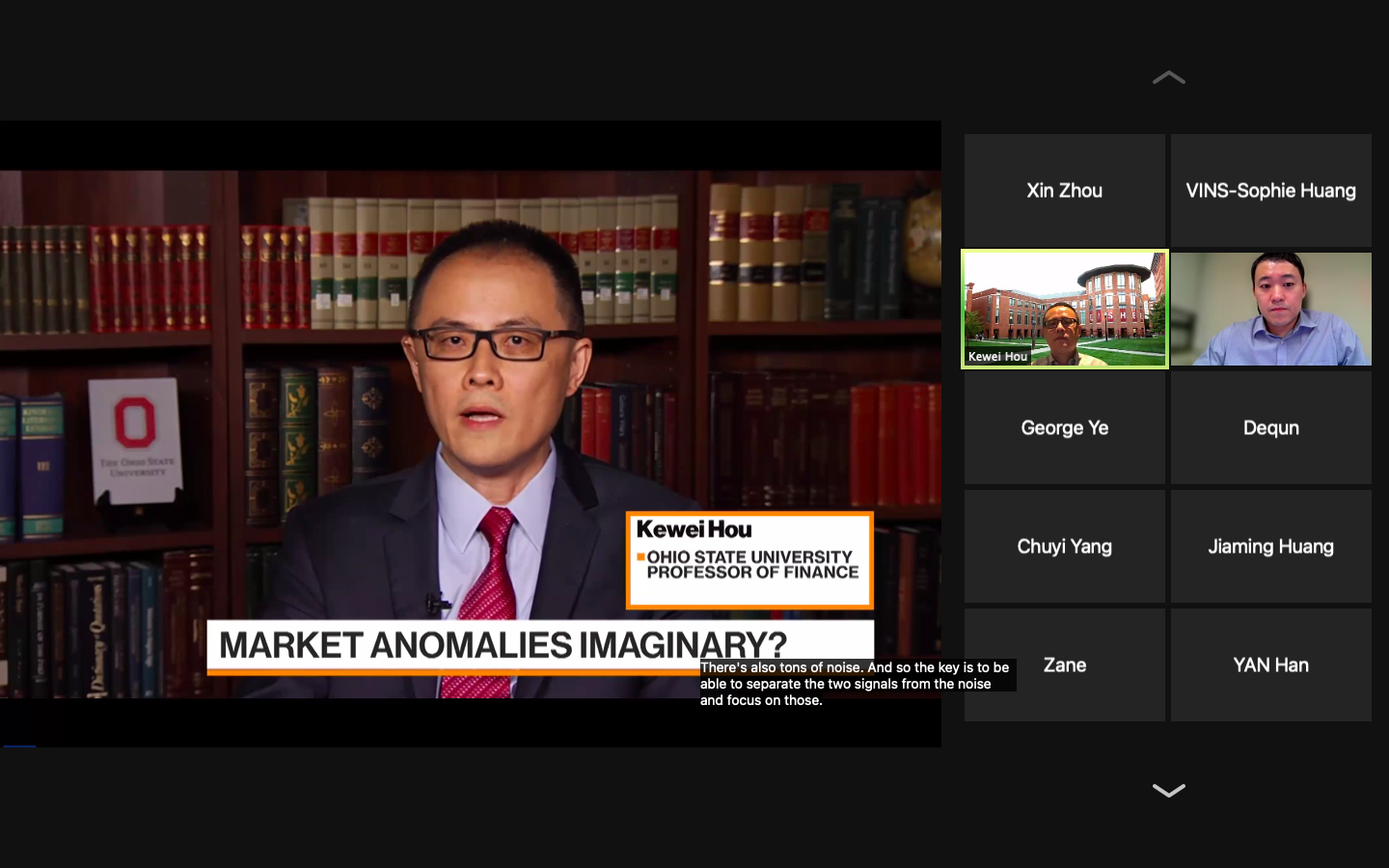

Featured instructors of this year were Professor Kewei Hou, the Ric Dillon Endowed Professor in Investments at Fisher College of Business, The Ohio State University and Professor Yan Liu, an Associate Professor of Finance at Krannert School of Management, Purdue University. “Professor Hou and Professor Liu are both world leading scholars in the field. They not only discussed the history, development and the latest studies of the factor models, but also shared their experience on how they got their papers published. This is very helpful to young scholars who are just starting their academic career. It is also one of the very reasons we host the summer school each year,” said NYU Shanghai Professor Zhou Xin, executive director of VINS.

The 2022 cohort were mostly PhD level students and junior faculty from institutions such as Chicago University, Imperial College Business School, University of Warwick, National University of Singapore and Tsinghua University.

PhD candidate in Finance Andrea Bartolucci from City University of Hong Kong believed the course was extremely helpful. “It is a way to be updated to the most recent state-of-art research practice in your field, being updated on recent literature, having an overview of the research topic, and finally networking with peer researchers,” he said. “I have learnt topics’ specific knowledge, especially regarding the methodology. I have also learnt how to present better and design better slides and narrative to disseminate my research.”

Founded in 2014, VINS seeks to create opportunities for market volatility research focused on both the Chinese financial markets and markets around the world. VINS facilitates collaboration among market participants and academic researchers within China and abroad. It also aims to help improve global financial markets by providing timely financial information and analysis to academics, practitioners, regulators and policymakers through innovative technology platforms and services.