Jan 19 2024

Published by

NYU Shanghai

No matter where a business operates, navigating government bureaucracy and regulations is a must. These bureaucratic hurdles, known as red tape, serve as essential tools for governments to regulate markets and alleviate negative impacts such as pollution. However, they also impose tangible costs on businesses, hindering investments and economic growth. Measuring these costs is a significant question for experts in macroeconomics and finance to explore.

A recent study by NYU Shanghai Assistant Professor of Finance Geoffery Zheng, and his collaborator, Columbia University Business School Assistant Professor of Business Bruno Pellegrino, introduces a fresh methodology to measure the actual economic costs imposed by government red tape. Their findings, published in the Journal of Financial Economics, provide insights for businesses, economists, and policymakers alike.

According to Zheng, prior efforts by organizations like academics and the World Bank focused on surveying firms directly to understand regulatory impact. Questions were mostly asked in qualitative format, such as “how much do you think your firm has been affected by certain regulations,” with answers including “from ‘not at all’ to ‘a lot.’” This approach, however, has limitations as qualitative answers given in surveys cannot be used to directly generate quantitative estimates. Researchers could only make assumptions from the survey, lacking statistical support. Meanwhile, company managers, when taking those surveys, might give subjective answers, which are not backed by real financial data.

To address these challenges, the new study proposes a methodology for converting qualitative responses into measurable GDP losses caused by red tape. Noting that within a country, the same regulations can be applied unevenly or affect firms differently, the methodology models the impact of regulations as a firm-specific ‘shadow tax,’ which is unevenly imposed on companies. The team utilized the Marginal Revenue Product of Capital (MRPK) figures of firms as a tool to measure the shadow tax imposed on each company.

MRPK represents the potential money-making ability of firms when adding extra capital. To illustrate, consider a factory: MRPK showcases how much more money a company could earn by investing in a piece of new equipment. Theoretically, companies grappling with red tape exhibit a higher MRPK compared to unconstrained companies, as they have the potential to make more money through scaling up. However, due to regulatory restrictions, they cannot realize this potential revenue, resulting in compromised potential earnings converted into GDP loss.

The next step, analyzing how the firms’ MRPK figures vary with their survey responses becomes crucial. Zheng notes that this is a more accurate way to determine economic costs. “If some firms report that they’re heavily impacted by regulation, but their MRPK is the same as that of unaffected firms, it suggests that the regulations might not be the primary cause of their challenges,” said Zheng. “It’s more likely those managers are just blaming regulation for their woes.” Once these “shadow taxes” are calculated, the team uses an economic model to quantify two key aspects: the reduction in capital investment due to regulations and the efficiency of capital allocation across firms. Both aspects are closely linked to the total GDP loss, said Zheng.

Applying this methodology to seven European countries, namely France, Italy, Spain, Germany, Hungary, Austria, and the United Kingdom, the study reveals that red tape indeed incurs real economic costs, with an average annual GDP loss of 154 billion USD, across these countries. The impact varies widely, even among developed European countries, showcasing the nuanced effects of regulation. The research highlights that the economic impact is not solely due to regulators favoring certain firms but is pervasive, leading to significant underinvestment.

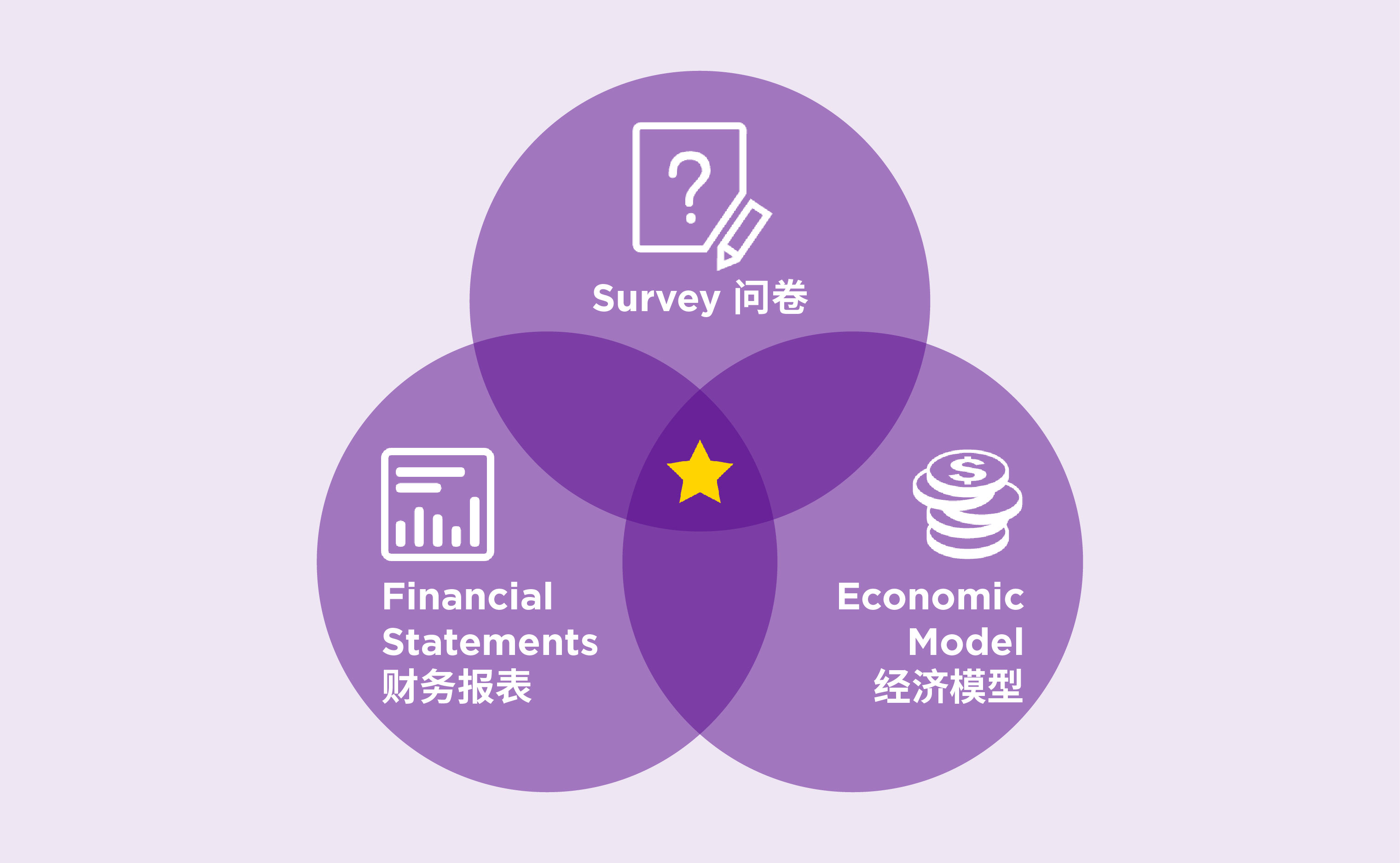

This innovative approach, integrating firm-level survey evidence, financial statements, and economic modeling for GDP loss, distinguishes itself from previous work on the cost of red tape. Zheng emphasizes that being at the intersection of all three elements makes their work unique. “Prior studies were in the overlap of at most two of these elements, which can sometimes lead to subjective or partial assumptions,” he said. Furthermore, he added, the proposed methodology can be applied to analyze other business determinants in other settings as well, such as how labor policies and subsidies would impact the economy.

This innovative approach, integrating firm-level survey evidence, financial statements, and economic modeling for GDP loss, distinguishes itself from previous work on the cost of red tape. Zheng emphasizes that being at the intersection of all three elements makes their work unique. “Prior studies were in the overlap of at most two of these elements, which can sometimes lead to subjective or partial assumptions,” he said. Furthermore, he added, the proposed methodology can be applied to analyze other business determinants in other settings as well, such as how labor policies and subsidies would impact the economy.

“Regulations are indeed a double-edged sword,” he said. “Their roles in mitigating issues such as pollution are essential but a balanced approach to avoid hindering economic output is also critical.” By providing quantitative evidence on the economic impact of regulations, he said, the study aims to help regulators recognize the genuine costs, even when regulations are applied fairly, and advocates for a cautious interpretation of firms’ complaints, emphasizing the need for hard data to substantiate claims of regulatory burden.