Sep 19 2023

Published by

NYU Shanghai

If you’re leading a startup and aiming to stand out in the job market competition against industry giants like Apple or P&G, here’s a winning strategy: invest in corporate social responsibility (CSR) initiatives that benefit your employees. A recent study led by NYU Shanghai Assistant Professor of Management and Organizations Tanya Yuan Tian and collaborators Brayden King and Edward B. Smith, from the Kellogg School of Management, delves into how organizations’ status and prestige are interconnected with CSR investment. The study, published in Strategic Management Journal, offers valuable insights for companies seeking an edge in the labor market.

The research establishes a cause-and-effect link between a company’s status and its commitment to employee-related CSR activities. Professor Tian suggests that this insight can be a powerful tool for companies with lower status, counteracting what’s known as the Matthew Effect (simply explained as “success breeds success”) in the status-segmented market. Under the Matthew Effect, higher-status firms enjoy more hiring advantages, forming a virtuous cycle competitively, while lower-status ones struggle to compete for talent. The study shows that investing in CSR can help companies maintain a competitive advantage when recruiting top talent.

In industry circles, CSR has been a hot topic for years. Tied closely to the Environmental, Social, and Governance (ESG) concept, CSR is valued by investors, businesses and academia. While there’s agreement on the importance of investing in CSR, evidence suggests that actual motivation for CSR initiatives might not be as high as anticipated. Tian and her collaborators wondered what might increase companies’ motivation to embrace CSR initiatives.

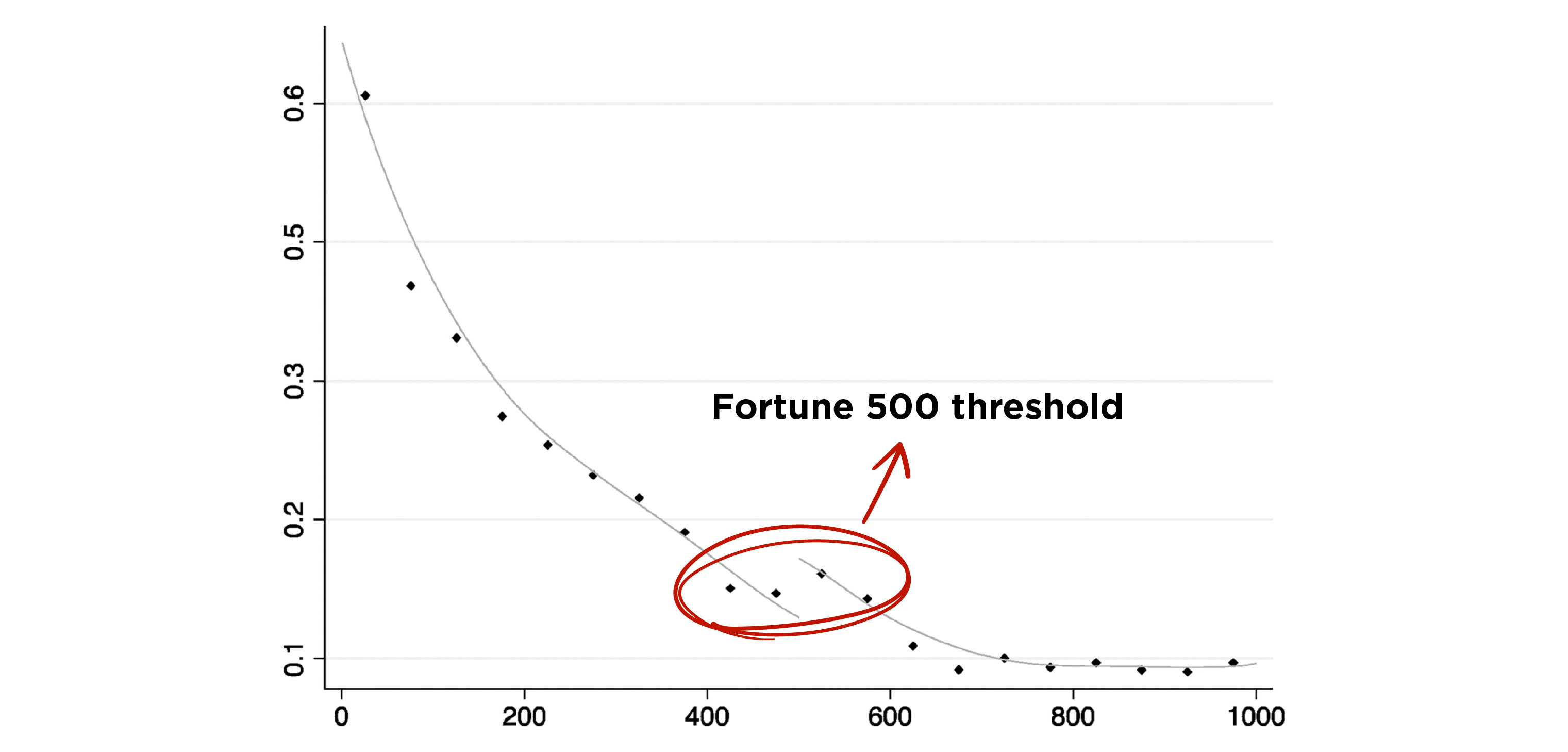

The team chose the Fortune 1000 rankings for their empirical investigation where they implemented a quasi-experimental design. In this context, the team argued that the Fortune 500th rank position creates a discontinuity in status at a precise location where quality difference can be assumed to be smooth. In other words, there is no reason to expect that the Fortune 499th and the Fortune 501st firms to be notably different in underlying quality, while these two firms vary in status as only the 499th firm may claim membership in the prestigious Fortune 500 category.

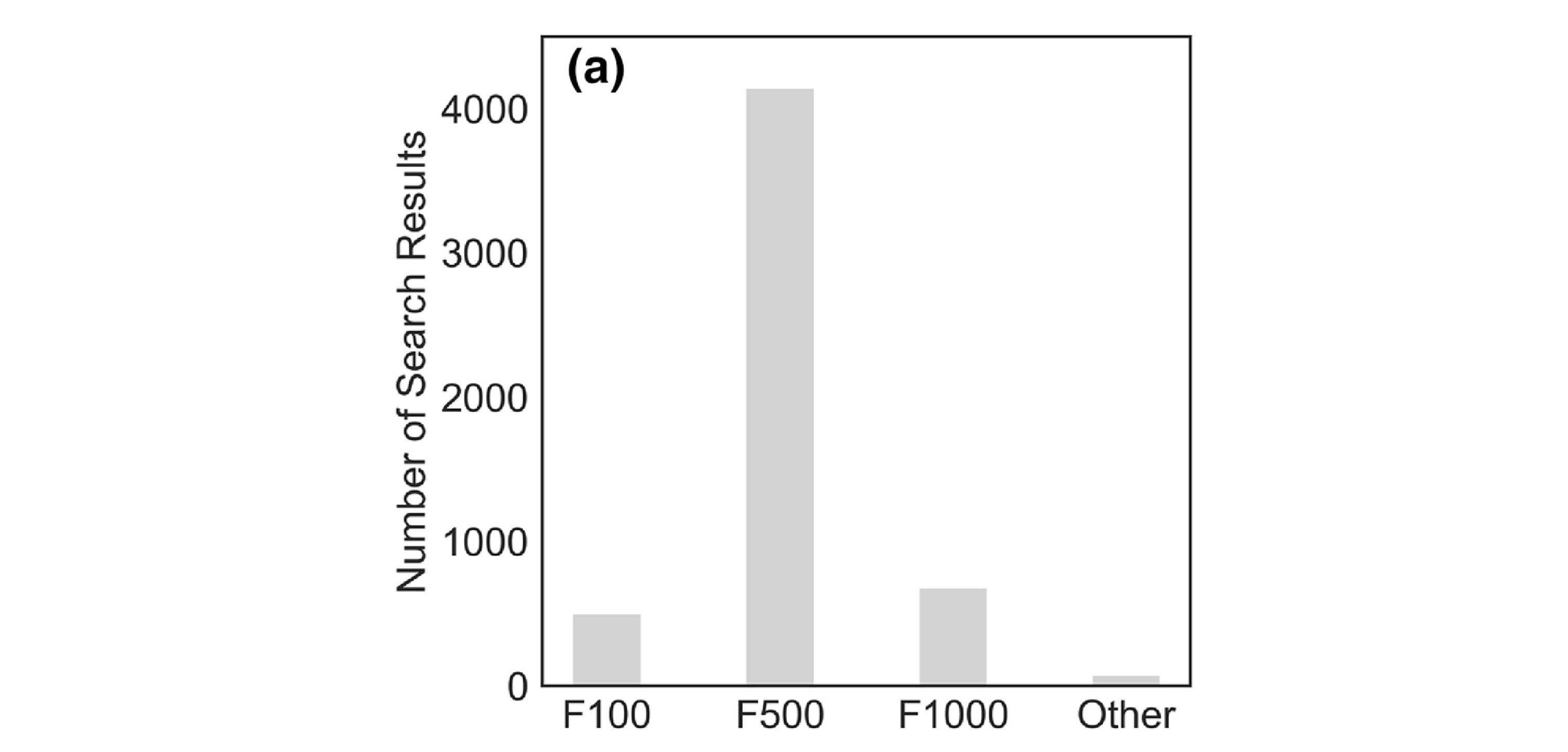

In the database, researchers compared media mentions of Fortune 500 vs Fortune 1000. Fortune 500 gets over 4x more attention

In the database, researchers compared media mentions of Fortune 500 vs Fortune 1000. Fortune 500 gets over 4x more attention

The researchers’ findings reveal that companies whose rank positions fall just below Fortune 500 tend to have better reputations when it comes to employee-related CSR. This logically reflects their investment in activities that prioritize their employees’ well-being compared to firms just within the Fortune 500.

Tian said that employee-targeted CSR efforts by companies can take many forms. A business might promote employee work-life balance through flexible work schedules and wellness programs. These initiatives can help create a positive and inclusive workplace that appeals to employees and attracts top potential talents.

The study found that companies just below the Fortune 500 threshold show higher commitment to employment-related CSR

The study found that companies just below the Fortune 500 threshold show higher commitment to employment-related CSR

“We explored various data sources, measurement methods, samples, and timeframes to confirm our findings,” Tian explained. “A significant portion of the paper focuses on testing the robustness of our results.” The conclusions remained consistent across different approaches, ensuring the study’s reliability.

Tian said the study helps make headway toward understanding the factors that motivate companies to invest in CSR. “It demonstrates that building a reputation for social responsibility can offset status gaps and make lower-status organizations more attractive to potential employees,” she said. “This addresses the questions from both academic and practical communities about strategies to motivate commitments to CSR engagement.”